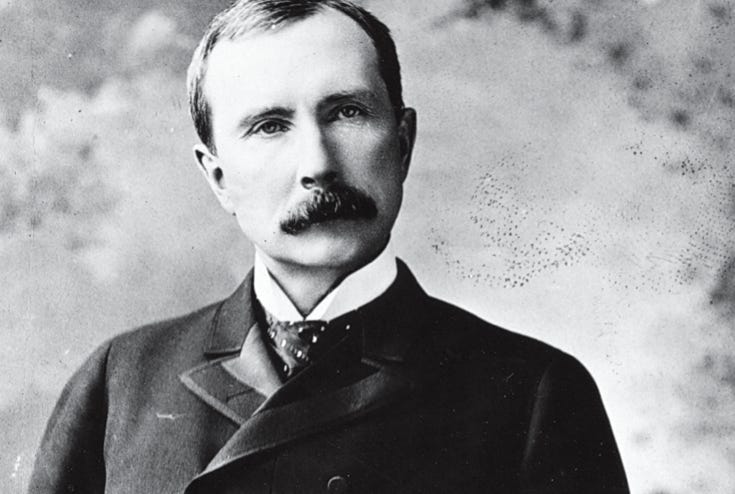

Hey there, trying to wrap your head around the finance maze? It’s tricky stuff, but guess what – we’ve got some nuggets of gold straight from Warren Buffet himself that could lead you right to the treasure chest. Stick with us as we break down five killer pieces of advice from Buffett’s wellspring of knowledge. We’re going deep into his smart investing tips and clever stock market plays because we want you prepped and ready for action when it comes to making those big financial calls. So come on along; let’s soak up all that brainpower from one heck of a financial genius and turn Buffet’s golden words into real-deal moves for beefing up your investment game!

Warren Buffett’s Top Investment Advice for Long-Term Success

Let’s talk about a legend in the investing game, Warren Buffett. He’s our guiding star in this complex universe of stock markets and financial forecasts. His formula might seem pretty straightforward: stick to what you get, stay patient, and keep your head on straight. So how do we take that sage advice if we’re trying to walk down the path blazed by Buffett? He hints at scouting for businesses with solid moats—the kinds folks say have staying power—because they can fend off competition over time like medieval castles did back in their day! Imagine putting your money into companies built for the long haul; it isn’t just today’s cash flow or hip market trends that matter but real sustainable growth able to roll with whatever punches Wall Street throws. Thinking like Buffett means rolling up your sleeves and really getting into a business’s nitty-gritty before throwing down your investment dollars—not riding every wave that comes along because hey, who knows when those waves will crash? Buffett’s strategies hinge on something you might not have thought about much: the caliber of the folks in charge. He’s all-in on believing that if a company is going to make it big, its leaders better be top-notch. Let’s face it – where would we be without someone solid steering the ship? That’s why before you dive into buying stocks, take a hard look at who’s running the show and whether they’ve got a stellar rep for making things happen. And hey, let us not forget Buffett is pretty keen on sniffing out deals in the stock market jungle – those undervalued stocks ripe for picking thanks to some savvy fundamental analysis. It’s like uncovering buried treasure but with shares! His advice? Keep your cool when everyone else is losing theirs and pounce when they’re too scared to move; that could just be your golden ticket right there when fear strikes Wall Street!

Financial Tips to Grow Wealth According to Buffett Insights

It’s not all about choosing winning stocks when you’re taking a page from Buffett’s wealth-building playbook. What really counts is shaping an expansive view of managing finances. Consider this core nugget: live beneath your means. Sure, it sounds straightforward – almost too simple, right? But here’s the clincher: by spending less than what you rake in, you’re left with extra cash that can be put to work and grow over time. Can you believe even someone as loaded as Buffett keeps things modest when it comes to his lifestyle?

Giving yourself a leg up financially doesn’t stop there, though! Take Warren’s advice seriously – he tells us that plunking down money on our own growth tops any investment out there. Think about leveling up skills or gobbling up new info; heck, just keeping fit also factors into bumping up your potential earnings through the roof in the long haul! There’s wisdom in Buffett’s words – “The more you learn, the more you earn.” Let those words sink in for a sec.

Buffett really hammers home how crucial it is to steer clear of debt, and let’s not even talk about the nightmare that is credit card debt. It just eats away at your potential financial growth like nothing else! Those sky-high interest rates? They’ll munch on the cash you could’ve put into some savvy investments. But here’s a twist: Buffett isn’t totally against borrowing. He says if you’re gonna use leverage, do it with finesse—make sure it boosts those returns without dragging you into a money pit. Now get this: compounding—it’s at the heart of Buffett’s whole game plan. Dude straight-up reveres compound interest as though it’s the ‘eighth wonder of the world’. And why wouldn’t he? You start dropping cash into investments early on, and bam—you watch them swell over time like magic beans growing into beanstalks reaching for gold in clouds! Don’t underestimate those tiny amounts; give ’em some time, sprinkle in compounding… before you know it, they’re snowballing towards something huge.

Essential Stock Strategy Lessons from Warren Buffett

Warren Buffett’s investment philosophy is a beacon for traders worldwide. He zeroes in on selecting stocks with an eye toward owning them forever—literally, he says that’s his preferred duration! Embracing this long-haul mindset steers clear of knee-jerk reactions to market fluctuations, instead valuing the true worth of businesses. Now here’s where it gets interesting: diversification. You might think spreading your investments thin is smart, but not according to Warren’s playbook. Instead of scattering resources across countless companies, Buffett bets big on just a handful he truly has faith in—suggesting you only need wide-ranging diversity if those business models are Greek to you. Buffett’s got a point, and you might want to lean in on this: Sometimes going against the grain pays off. He doesn’t just follow everyone else; instead, he scouts for hidden gems where most wouldn’t bother looking. Think about it—ever considered putting your money into a sector that’s not getting any love or backing companies currently down on their luck? That could be where the real growth is waiting. Remember, stocks aren’t just random letters scrolling across a screen—they’re pieces of an actual business pie. When you snap up those shares, congratulations! You’ve just bagged yourself a slice of ownership in that company. So treat it like your very own brick-and-mortar shop—you’ve gotta have faith in its journey ahead, right?

How Warren Buffett’s Investment Principles Can Guide You

You don’t need a mountain of cash to follow Warren Buffett’s investment playbook—just a solid grasp on the essentials of smart investing. He preaches disciplined methods, insisting you dig deep into your potential investments. Got it? It means rolling up your sleeves, diving into financial reports, and really getting to know the ins and outs of companies before cozying up with them in your portfolio.

And here’s another golden nugget from Buffett: patience pays off. The stock market tends to tip its hat to cool-headed folks who wait out the storms instead of those knee-jerk reactors chasing every uptick or downturn. A big chunk of Buffett’s own fortunes comes from sticking it out through thick and thin—not making snap calls that could trip you up on reaching those ambitious future milestones.

Buffett’s strategy? It’s all about spotting the real worth of a company – that’s intrinsic value for you. Think of it as what something is actually valued at, not just its price tag on Wall Street. And then there’s this thing called margin of safety; basically, it means you’re getting a deal by paying less than what the biz is really worth. Why does this matter to us? Well, aside from giving us some wiggle room if our calculations are off (hey, nobody’s perfect), it also sets up chances to make more bank. Now let me tell ya something about market timing—Buffett sees it as playing the fool. Sure, we’ve all heard that old “buy low and sell high” line—it sounds slick but trying to guess those ups and downs is like riding a rollercoaster in the dark… without a seatbelt! So here’s Buffett flipping the script: snag solid companies when they’re priced right—not cheap or expensive—and stick with them while they continue being top-notch performers. Trust me; your nerves will thank you later since waving goodbye to second-guessing every dip and rise frees you up for big-picture moves over time.

Unpacking Warren Buffett’s Most Valuable Financial Tips

Hey, let’s dive into some nuggets of wisdom from Warren Buffett that could seriously boost your money game. Got a safety net? That’s tip number one: Keep a stash of cash handy. Think of it like an emergency oxygen supply you’d need if things got tight financially, so you won’t have to ditch your investments at rock-bottom prices. And hey, don’t just play the market by ear; get the 411 on what risk really means. It’s way more than how much an investment bobs up and down in value—it’s about getting cozy with the ins and outs of where you’re putting your bucks. Take it from Buffett—he steers clear from industries that are Greek to him because no matter how shiny they look, he sticks to this truth bomb: Sinking dough into learning pays off big time. Got another nugget of wisdom for you: Steer clear of letting your emotions call the shots in investing. Ever heard Buffett caution about being swayed by fear or greed? Trust me, those feelings can really fog up your brain and make you do things on a whim that stray from your solid investment strategy. Keep a cool head—think clearly and neutrally to nail those financial choices. And here’s the scoop when Buffett gets into ‘guarding against the institutional imperative’. It’s like this—a bunch of companies play follow-the-leader without thinking, which doesn’t always end well for them. So what should you do? Look at each company with fresh eyes based on their own moves and goals instead of just tagging along with industry fads. Thinking outside the box isn’t just smart; it could seriously beef up your bank account.